Quick Links

For decades, banks and financial institutions have relied on traditional paper and online bank forms to collect information from customers. While these forms serve a purpose, they can be cumbersome, time-consuming, and even lead to frustration for both customers and staff.

Have you ever wondered what forms are there in the bank and why filling them out can be such a hassle? Common bank forms include applications for accounts, loans, and credit cards, as well as account opening forms, W-9 forms, and even forms for closing accounts. Thankfully, the financial landscape is evolving, and a new generation of bank forms is emerging – conversational form technology.

Imagine a more engaging way to complete those bank forms. Instead of static questions and drop-down menus, conversational forms utilize interactive elements to create a more dynamic and efficient experience. Think of it like having a helpful assistant guide you through the process. This conversational form would ask you clear questions, step-by-step, offer helpful explanations if needed, and collect all the information the bank needs in a streamlined manner.

According to a McKinsey study, banks with higher customer satisfaction grow deposits at a significantly faster rate (85% more) compared to their competitors. This highlights the importance of prioritizing customer experience in today’s financial services landscape. Conversational forms offer a solution to enhance customer satisfaction by streamlining interactions and making the process more engaging.

Unlocking Efficiency with Conversational Forms

Conversational forms, also known as smart form solutions for banks, offer a multitude of benefits.

- Improved Customer Experience: Traditional bank forms can be complex and confusing. Conversational forms offer a more user-friendly experience by guiding customers through the process step-by-step. This reduces frustration and leads to higher customer satisfaction.

- Increased Loan Application Completion Rates: Complex or lengthy bank forms can discourage customers from completing loan applications. Conversational forms simplify the process and make it easier for customers to finish their applications, leading to a higher completion rate.

- Faster Processing Times: Conversational forms can automate data entry and verification, reducing the time it takes for banks to process applications and requests. This translates to faster service for customers and improved efficiency for banks.

- Reduced Errors: Traditional bank forms are prone to errors due to manual data entry. Conversational forms minimize errors by collecting information through clear, interactive steps. This saves time and reduces the need for rework.

- 24/7 Availability: Conversational forms are available to customers anytime, anywhere. This allows customers to complete applications and inquiries on their own schedule, even outside of regular business hours.

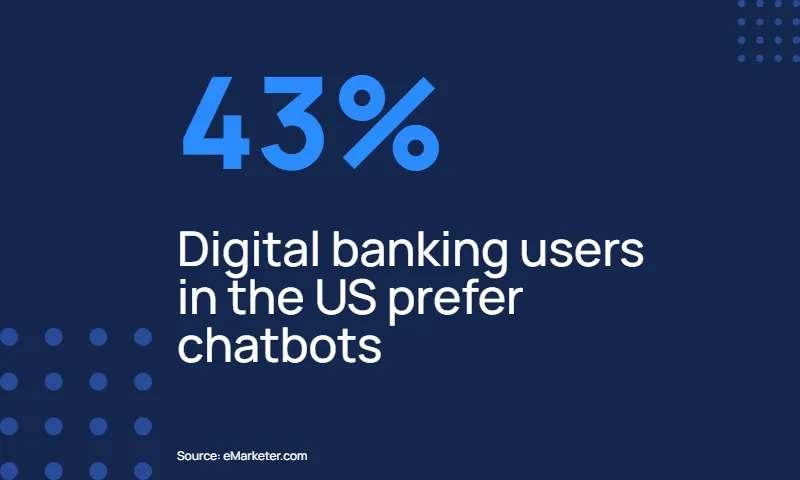

In fact, a recent study by eMarketer showed that 43% of digital banking users in the US prefer chatbots. Conversational forms can be seen as an extension of chatbots, offering a more structured way to collect information while maintaining a user-friendly and interactive experience.

Conversational Form Solutions for Banks

The potential of conversational forms for financial institutions and banks is vast. Here are some specific applications:

- Conversational forms for loan applications: Streamline the loan application process for mortgages, student loans, and other types of loans.This includes conversational forms for mortgage applications and conversational forms for student loan applications, making it easier for customers to apply for the financing they need.

- Interactive credit card inquiries: Allow customers to pre-qualify for credit cards and learn about different options through an interactive dialogue.

- Conversational forms for account opening: Make account opening a breeze for new customers with a simple, conversational approach.

- Conversational forms for customer support: Offer 24/7 customer support by enabling AI chatbots to answer basic questions and collect information.

Developing Conversational Forms for Banks

Conversational form development for banks requires a specific approach. Here are some key considerations:

- Security: Protecting customer data is paramount. Banks must ensure their conversational forms comply with all data security regulations.

- Integration: Conversational forms should seamlessly integrate with existing bank systems for efficient data processing.

- Customization: Banks can tailor conversational forms to their specific needs and branding guidelines.

Use cases of Conversational Forms for Banks

You’re likely familiar with the traditional bank application forms you’ve been using. However, it’s time to reimagine them.

The future lies in conversational forms. These forms are designed to be more intuitive, interactive, and user-friendly. So, while you may be accustomed to the old way of doing things, it’s time to embrace this new era of banking technology.

In the next few years, the traditional bank application forms will transform into conversational experiences, making the process of applying for loans, opening accounts, and more, a breeze.

Banking Application Forms Reimagined

- Account Opening Form

- W9 Form

- Bank Account Registration Form

- Debit Card Application Form

- Bookkeeping Client Intake Form

- Visa Credit Card Application Form

- Credit Card Application Form

- Standing Order Mandate Form

- Credit Repair Consultation Form

- Account Closing Form

- Cheque Requisition Form

- Credit Application Form

- Personal Financial Statement Form

- Application For Credit Form

- Income Certificate Application Form

- Financial Planning Questionnaire

- Bank Enrollment Form

- Client Qualification Form

- Checking Account Reconciliation Form

- Borrower’s Authorization Form

- Fast Track Application Form

- TNT Application

- Loan Estimate Form

- Broker Accreditation Form

Building Your Conversational Banking Future with WayMore

WayMore offers a suite of features that make building and deploying conversational forms in the banking industry a breeze:

- Drag-and-Drop Builder: Intuitively design your conversational forms using WayMore’s drag-and-drop interface. This eliminates the need for coding knowledge and allows banks to focus on tailoring the forms to their specific needs.

- Ready-Made Templates: Get a head start with WayMore’s library of pre-built conversational form templates. These templates can be easily customized to fit various bank application scenarios, saving you valuable development time.

- AI-Powered Generation: Leverage WayMore’s AI capabilities to streamline the creation process. The AI can suggest prompts, responses, and branching logic based on best practices, ensuring your forms are efficient and user-friendly.

The Future of Bank Forms: A Conversational Revolution

The adoption of conversational form technology is on the rise within the financial services industry. Banks and financial institutions that embrace this innovation stand to gain a significant competitive advantage. By offering a more efficient and user-friendly experience, banks can attract new customers, improve customer satisfaction, and streamline internal processes.

Conversational forms represent a significant evolution in the way bank forms are used.

They offer a glimpse into the future of financial services, where customer interactions are personalized, efficient, and readily available.

Curious to learn more? WayMore’s experts are ready to chat!

FAQs

Traditional bank forms are static with fixed questions and answer choices. Conversational forms, on the other hand, are interactive. They use a question-and-answer format, like a dialogue, to guide you through the process. Imagine having a helpful assistant asking you clear questions and offering explanations if needed. Conversational forms are designed to be more user-friendly and efficient than traditional forms.

Conversational forms offer several benefits for banks and their customers. Here are a few:

- Improved customer experience: Conversational forms are easier to understand and navigate, reducing frustration for customers.

- Increased loan application completion rates: The simpler process encourages customers to finish loan applications.

- Faster processing times: Conversational forms automate data entry and verification, speeding up processing times for banks.

- Reduced errors: Clear, interactive steps minimize errors caused by manual data entry.

- 24/7 availability: Customers can access and complete forms anytime, anywhere.

Conversational forms have a wide range of applications in banks, including:

- Loan applications (mortgages, student loans, etc.)

- Interactive credit card inquiries (pre-qualification, different options)

- Account opening (simplified process for new customers)

- Customer support (24/7 availability with AI chatbots)

Security is paramount for banks. Conversational forms developed specifically for banks are built to comply with all data security regulations, ensuring your information is protected. For example, companies like WayMore have builders that prioritize security and ensure their conversational forms meet the strictest data protection standards.

Companies like WayMore offer tools and features to make building and deploying conversational forms in banking a breeze. These features include drag-and-drop builders, pre-made templates, and AI-powered generation to simplify the process. Try it for free today!

Curious to learn more? WayMore’s experts are ready to chat!